Hi,

If your income stopped tomorrow, what would first break?

Not eventually.

Not “in theory.”

I mean first.

I’ve been thinking about this a lot lately — I realise how much of modern life quietly assumes income will just keep arriving.

Pay checks come in. Clients pay. Bonuses land. Promotions happen.

Until they don’t.

And the real risk isn’t that income disappears forever. It’s that it pauses — briefly — and your life doesn’t have the flexibility to absorb it.

That’s what I mean by fragility.

Most people are closer to the edge than they realise

A few numbers put this into perspective:

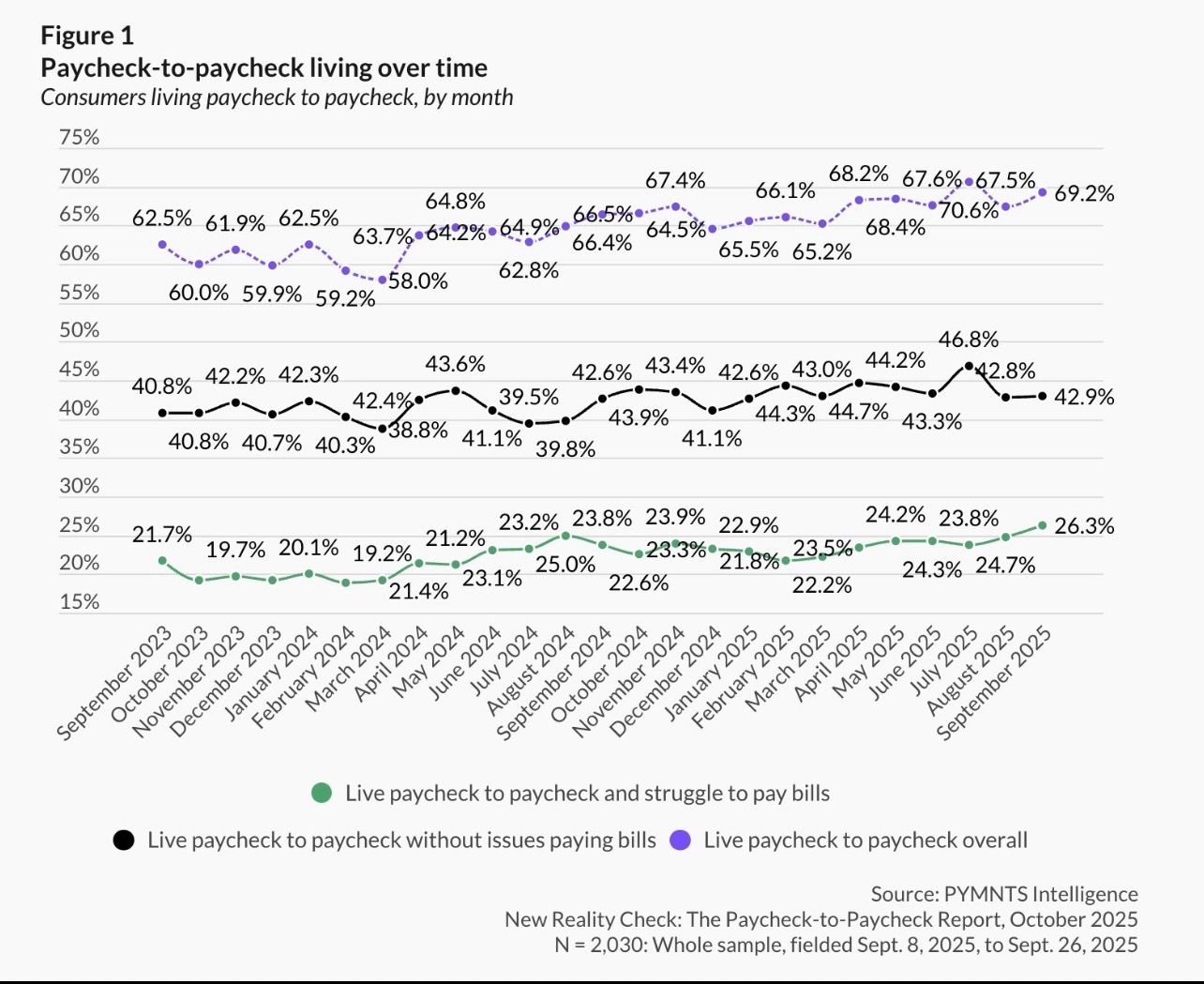

In the US, roughly 70% of adults live pay check to pay check.

Nearly 1 in 3 couldn’t cover a $400 emergency without borrowing or selling something.

What surprised me most is that this isn’t just about low income. Even among people earning six figures, many still don’t have much real cash buffer.

Higher income often just supports a more expensive version of the same setup.

The issue usually isn’t poverty.

It’s rigidity.

Income feels stable — until it isn’t

Most financial plans quietly assume income is predictable.

That assumption holds… right up until it doesn’t.

Layoffs, restructures, health issues, burnout, industry shifts — none of these are rare. And when income pauses, even temporarily, that’s when stress shows up fast.

Not because of food or utilities.

But because obligations stay fixed while cash flow doesn’t.

That’s where things start to break.

The question I find most useful

I don’t think the most helpful question is “How much do I have?”

The better one is:

Which of my expenses are fixed — and which are flexible?

Two people can earn the same amount and have completely different experiences when income is disrupted.

One has modest fixed costs, real savings, and room to adapt.

The other has high housing payments, locked-in lifestyle costs, and very little margin.

Same income.

Very different stress.

Fragility hides in commitments, not balances.

What usually breaks first

When income pauses, it’s rarely the basics.

It’s things like:

large monthly housing payments

long-term car finance

debt that assumes uninterrupted income

subscriptions and lifestyle costs that quietly stack up

What often hurts most isn’t the maths — it’s the psychology.

Watching cash drain while obligations stay fixed forces bad decisions: selling investments at the wrong time, taking the wrong job, or leaning on expensive credit just to keep things “normal.”

What resilience looks like to me

I’ve come to think of resilience as optionality — the ability to pause, adjust, and choose.

A few things that genuinely help:

A real rainy-day fund.

Cash, not investments. Enough to buy time, not returns.Fixed costs below what your income technically allows.

Living below your maximum creates breathing room you don’t notice — until you need it.Investing without forced selling risk.

Cash buffers protect portfolios more than perfect allocation ever will.More than one income stream, eventually.

Not constant side-hustling — just avoiding a single point of failure.A mindset shift.

I no longer see cash as lazy money or flexibility as inefficiency.

Optionality is an asset.

One simple exercise worth doing

I’ve found this question clarifying:

If my income stopped for 90 days, what would I need to change immediately?

Not “what would hurt.”

What would force change.

The answer usually points very clearly to where attention should go next.

The goal isn’t to predict disruption.

It’s to make sure a pause doesn’t force panic.

Financial resilience rarely shows up when things are going well.

If you’re comfortable sharing, hit reply and tell me: what would break first for you?

You’ve got this.

— Ben